Industry Tips and News

Read the latest ILG news, and fulfilment and delivery insights in our articles, ebooks and videos below.

For the most recent customer updates, please visit the My ILG page.

15 April, 2024

How to Make Your Order Fulfilment More Sustainable

As brands become increasingly dedicated to operating sustainably, it’s vital that their supply chain partners are equally environmentally conscious to create an aligned vision for their customers.

27 March, 2024

The Beauty of Seamless Returns: Why Working with a 3PL is Essential

Returns have become an inevitable part of online shopping, and in the beauty industry, they play a significant role in customer satisfaction and brand loyalty.

28 February, 2024

Delivery to Retail With a Trusted 3PL

Not all fulfilment providers offer delivery to retail or wholesale fulfilment. Partnering with a 3PL that does is essential to reach customers through all channels.

12 February, 2024

Delivering Love, One Package at a Time: Your 3PL Partner for Heartfelt Logistics this Valentine’s Day

As the demand for personalised presents continues to rise, e-commerce brands are recognising the importance of offering value-added services like personalisation and gift wrapping.

05 February, 2024

How Fast and Reliable Shipping Aids Growth

How your business treats shipping can have a big impact on how online shoppers choose to make a purchase. Read about the benefits of working with a 3PL that gives you multiple shipping options here.

25 January, 2024

Peak 2023: Is Beauty a Recession-Proof Sector?

Is beauty recession-proof? We take a look at the numbers behind Peak 2023, how ILG customers performed and why beauty is bucking the trends.

19 January, 2024

Is Your 3PL Handling Quality?

For any business that produces goods for the consumer market, the importance of quality control (QC) cannot be overstated.

29 November, 2023

How to Prepare Your Beauty Business for Sweeping New US Regulations

The United States Food and Drug Administration (FDA) is set to implement significant modifications to cosmetic regulation, find out how to prepare your beauty business here.

13 November, 2023

How to Scale Your Beauty Brand with a 3PL

Find out how working with the right 3PL can grow your beauty brand, elevating your offering and expanding your reach to meet growing demand.

23 October, 2023

How to Prepare Your E-Commerce Business for Global Peaks

In the West, certain annual peaks are given for e-commerce but many countries have their own traditions, and preparing for these ahead of time will mean you can get the most benefit from these peaks.

16 October, 2023

Five Steps To Switching Your Fulfilment Provider

For every business that relies on a fulfilment/3PL partner to get products into the hands of their customers, working with the right provider is a must.

25 September, 2023

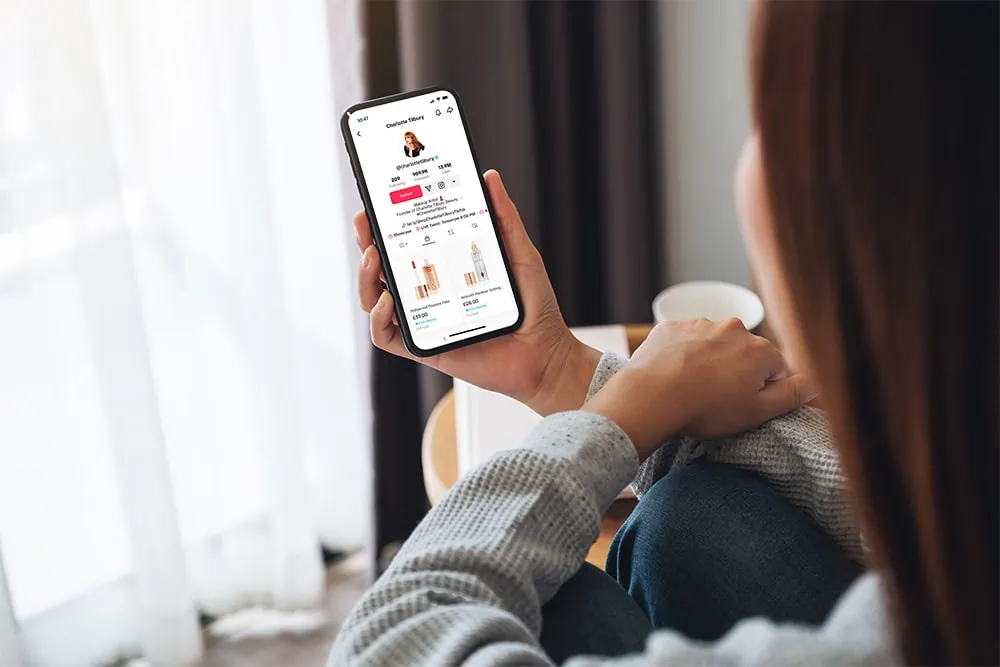

How TikTok’s Potential Change in Policy May Signal a New Era of Opportunity for Brands

News of a potential change to TikTok’s policy regarding external links could have significant implications for brands and their social commerce activities.

18 September, 2023

How is the Gen-Z Consumer Transforming the Beauty Market?

Gen-Z has significant power to influence the way brands launch, market and distribute their beauty products. We explore the ways Gen-Z is influencing beauty brands.

25 July, 2023

How AI is Shaping the E-Commerce Customer Experience

With e-commerce continuing to define modern retail, we’re firmly in an age where digital technology is at the helm of the customer experience.

15 June, 2023

The Growth of Subscription Beauty and How it Can Help Brands Retain Their Customers

In this blog we look at the growth of subscription beauty services and how beauty brands can make the model work for them.

13 June, 2023

Brexit Developments – Is the Situation Improving for UK Businesses?

In this article we summarise what has happened as a result of Brexit in terms of trade, investment and labour and how that has impacted on European fulfilment and logistics.

30 May, 2023

How Your Business Can Benefit from a Multi-Carrier Delivery Partner

Starting your journey with a delivery partner or carrier that secures the best ROI for your business is only the first piece of the puzzle – then comes managing day-to-day delivery needs and making adjustments to your account where necessary.

17 May, 2023

Sustainable Fashion

Why saving the planet makes sense for clothing and accessory brands. In this article we look at new regulations, the actions fashion brands need to take and the benefits of these actions for the planet, its people and the fashion business.

10 May, 2023

How Our Fulfilment Clients Benefit from a Long-Term Partnership

At ILG, one of our key metrics for success is the growth of our clients. Our mission is to make our customers more successful, and we believe this is best achieved through long-standing partnerships with them.

05 April, 2023

How to Make Your E-Commerce Packaging More Sustainable

Choosing the right delivery packaging for your beauty and wellbeing products is vital. Balancing a perfect unboxing experience and the sustainability of your outer packaging materials can transform the experience for your customers.

14 March, 2023

Summiting the Peak Season: Peak 2022 in Numbers

2022’s peak season was a strong one for e-commerce and retail brands. Here’s how it fared in numbers, and how we tackled it for our fulfilment customers.

22 February, 2023

Why Overstocking is Under-Performing

With supply chains in disarray and brands nervous of disappointing customers by running out of products, overstocking is now a global phenomenon.

27 January, 2023

How to Effectively Navigate E-Commerce Returns

Online shopping hasn’t just revolutionised the way customers buy; it’s also revolutionised the returns process.

04 January, 2023

How Your 3PL Can Fulfil Orders in the European Market

For e-commerce businesses growing into EU markets, reliable European fulfilment is the first step on your path towards international success.

12 December, 2022

Crossing the Atlantic: What US Beauty Brands Need To Know About Entering The UK Market

Cracking the UK is far from plain sailing and requires key partners on the ground with local knowledge. So, what do US beauty brands need to know?

29 November, 2022

What are the Benefits of Omnichannel Fulfilment?

Omnichannel fulfilment is the provision of fulfilment services for all of a brand’s retail channels. For most brands these services are split between multiple fulfilment partners. Here we look at the advantages of bringing them all together under one.

23 November, 2022

Why Client Service is Key to a Successful Fulfilment Partnership

Successful fulfilment is about more than just meeting orders at peak. Find out how client service can enhance the 3PL experience here.

17 November, 2022

4 Tips for Choosing Your Beauty 3PL Partner

Choosing to outsource your beauty fulfilment – whether for the first time or when moving to a new 3PL provider – is a big decision and one that is crucial to get right.

05 October, 2022

How to Improve Customer Experience During Peak Times in Ecommerce

When it comes to e-commerce, customer experience is key, especially during peak seasons. When trying to appeal to new customers, and keeping current customers happy with your service, there are many ways to improve your customer service.

29 September, 2022

7 Tips for Maximising Success During Peak Season

With businesses across the nation preparing for the busier shopping period, now is the perfect time to refine your peak season planning. We’ve compiled a list of tips to maximise success during peak.

05 August, 2022

Heading for a Recessional Peak?

Find out how an exceptional customer experience and building brand loyalty can help brands as purse strings of UK consumers tighten.

26 July, 2022

How a 3PL Company can Personalise Your Fashion Brand’s Products

Product personalisation is a vital part of fashion fulfilment and one that ambitious fashion brands can leverage to give orders a bespoke feel.

30 June, 2022

The New Packaging Levies, Part II – How Beauty Brands Can Adapt for the Better

We take a look at how the introduction of Extended Producer Responsibility (EPR) for packaging in 2023 will affect beauty brands.

28 June, 2022

UK-Australia Free Trade Deal Promises New Opportunities for ILG Customers

In December 2021, the UK signed a free trade agreement with Australia, which will offer some significant benefits for ILG customers.

27 June, 2022

Why a 3PL Provider is the Best Choice for Order Fulfilment

If you’re at the helm of a growing retail brand, getting your ecommerce and retail order fulfilment right is essential.

21 June, 2022

CEW Announces Beauty Awards Finalists

The CEW Beauty Awards are back for 2022 and with over 300 entries from more than 175 brands, the finalists have been revealed!

15 June, 2022

Pick and Pack with ILG

Pick and pack is an important part of the process for businesses as they strive to offer the best e-commerce experience for their customers.

24 March, 2022

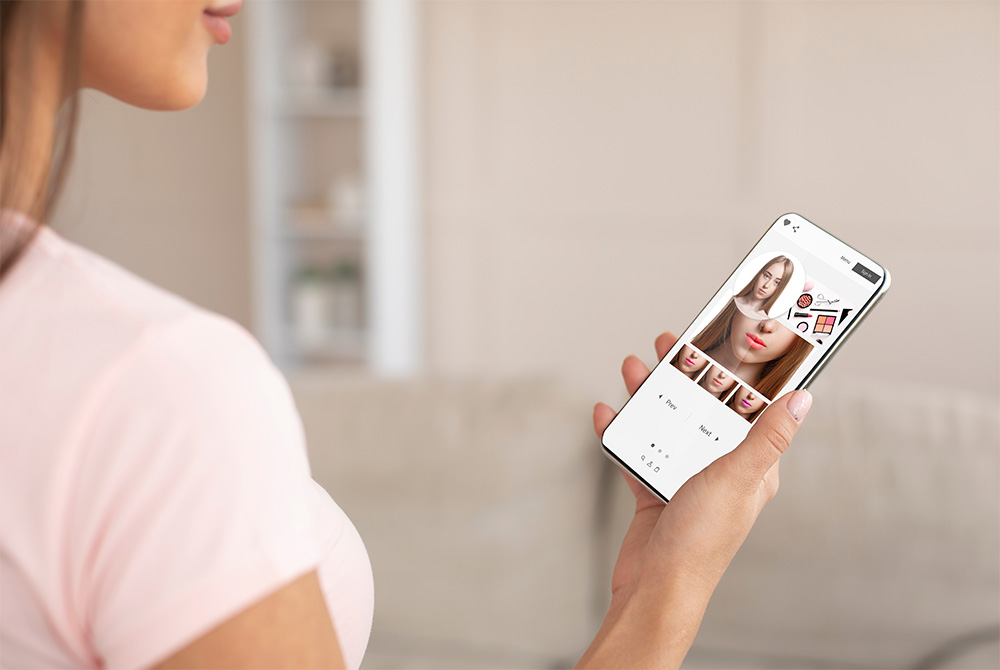

The Growth of Digital Technology in Beauty Marketing

Here we look at some of the stand-out examples of beauty brands embracing AI, AR and VR and consider how the technology might evolve in the coming years.

15 March, 2022

New Packaging Levies, Part 1

Two new pieces of legislation are set to transform the way UK businesses approach packaging. How will these new laws apply, who will be affected and what should you be doing to prepare?

22 November, 2021

Stocking up for Black Friday? Is your 3PL Prepared?

In Parts 1 and 2 of this series on Black Friday 2021, we’ve looked at consumer behaviour and retailers’ attitudes in this year of disruption and unpredictability.

08 November, 2021

Twist or Stick? How Retailers are Approaching Black Friday Amid Huge Market Uncertainty

Since it landed in the UK in 2013 Black Friday has forced retailers to completely rethink the traditional Christmas shopping period and post-Christmas sales.

03 November, 2021

Peak or Trough? Why Customer Behaviour is So Hard to Predict This Year

Black Friday falls on 26th November this year and retailers will be hoping for a spectacular uplift in sales.

21 September, 2021

The Global Logistics Crisis and What UK Retailers Can Do About It

The world is currently experiencing a crisis in the shipment of goods and it’s affecting UK businesses more than most.

18 August, 2021

Congratulations to CEW Beauty Awards Finalists

ILG clients are set to win big at the 2021 CEW Beauty Awards. With 359 entries across 33 categories, this year’s event was the biggest CEW Beauty Awards so far.

16 July, 2021

CEW Puts our Beauty Fulfilment to the Test

Our beauty fulfilment teams have been busy supporting the CEW 2021 Beauty Awards Product Demonstration Event.

25 May, 2021

Brexit and the Road to Poland – Part 3

The Founder of Little Green Radicals talks about the advantages of moving stock to the EU in Part 3 – The client’s tale.

23 April, 2021

Brexit and the Road to Poland – Part 2

Our decision to open a warehouse in Wroclaw, Poland, was signed off in September 2020 and I was assigned to manage the project the following month.

08 April, 2021

Brexit and the Road to Poland – Part 1

In January 2020, with one year left until the UK left the EU, we made the decision to prepare a contingency plan in the event of a hard Brexit.

27 January, 2021

Peak of Peaks: Black Friday 2020

It’s official: the Black Friday peak pre-Christmas 2020 was the busiest period ever at ILG. Take a closer look at the numbers behind the ‘Peak of Peaks’.

11 December, 2020

Ready for Brexit? Read our Checklist

Brexit is happening. With just days left until new rules and processes come into force on 31st December, all UK businesses that trade with the EU need to be prepared.

23 November, 2020

Building More Space for Black Friday

Watch our video to see how ILG has been preparing to meet record Black Friday demand.

29 October, 2020

Delivering a Successful Peak – Part 3

When I grew up, there was no e-commerce or online sales at Christmas time. The challenges we grappled with then were a world apart from those we face today.

22 October, 2020

Delivering a Successful Peak – Part 2

As time passes and ILG and our clients continue to grow, each peak period throws up new challenges which we must prepare for and overcome.

15 October, 2020

Delivering a Successful Peak – Part 1

As we count down the days to our expected peak trading period from 16th November, I would like to take a moment to reflect and give you an insight into what ILG is doing to ensure we deliver a successful peak.

30 September, 2020

6 Black Friday 2020 Retention Tips

How to keep newly acquired Black Friday sales customers coming back for more.

14 September, 2020

Are You Ready for a No-Deal Brexit?

On Thursday 10th September, we hosted our first webinar, tackling the main areas of concern as we approach that 31 December watershed.

10 September, 2020

How Black Friday 2020 will be Different and 5 Ways to Prepare your Business

As the days count down to Black Friday on 27th November, Cyber Weekend 2020 is set to become the most challenging peak period ever for retailers, fulfilment providers and delivery companies.

12 June, 2020

Safe-Sign for Safe Signing and Deliveries

As lockdown continues, keeping our distance and avoiding contact with non-householders are still our best protections against Covid-19 infection.

10 June, 2020

Has COVID-19 Turned Europe into an Online Market? And What Should You be Doing About It?

It won’t come as any surprise that e-commerce has experienced a major spike during the coronavirus pandemic.

29 January, 2020

Forward Planning – How to Best Prepare Your Company for Peak Periods

Last year’s peak November sales period was our busiest ever at ILG – by some considerable margin – and feedback from our clients shows that it was a successful period for our customers too.

23 October, 2019

Many Happy Returns: How Retailers Can Win New Customers this Christmas

A recent survey* of 15,800 consumers worldwide found that 77% of them are already planning to return a proportion of the gifts they receive this Christmas.

06 June, 2019

5 Logistics Tech Trends Offering Brands a Competitive Advantage

In this article, we’ll go through the main ways tech is impacting the fulfilment and delivery industry.

01 April, 2019

How to Perfect Your Product Packaging

The fulfilment expert’s guide to sustainable, stand-out packaging. Impending legislation (coming in 2022) is forcing businesses to reconsider their choice of packaging.

11 November, 2018

They Think it’s all Dover… are you Prepared for When the Brexit Whistle Blows?

The main areas of concern for UK businesses currently importing or exporting goods to Europe.

01 June, 2018

5 Ways your 3PL Partner can Support D2C Beauty Sales

Shopping habits are changing, a trend significantly accelerated by the market disruption caused by COVID-19.

03 May, 2018

Meeting the Challenges of Reverse Logistics (and Turning Them to your Advantage)

Returns have always been a fact of life for retailers. Some have treated them as a selling point, others have tried to pretend they weren’t happening.

21 July, 2017

Secrets of a Warehouse Stock Manager

Continuing our series in which ILG Head of Projects and Development, Lee Simmons and I address the key questions customers ask about outsourcing their fulfilment operations.

29 June, 2017

Top Tips for Efficient Receipt of Goods

The arrival of goods at our warehouse from your supplier marks a complex transition point. To ensure that this receipt of goods happens smoothly and without mishap, we follow a tried and tested procedure.

26 April, 2017

Key Considerations when Importing Stock

Many of our clients have their products manufactured or sourced abroad and shipped to the UK. This requires an understanding of the import and customs clearance process.

23 March, 2017

Why it Makes Sense to Outsource your Fulfilment

Based on feedback from our customers, the chief reasons for choosing to outsource fulfilment are a desire to grow their businesses and to get away from managing warehouses!

28 February, 2017

When to Outsource Your Fulfilment…and Who to Trust it to

The decision to outsource your fulfilment to a third party is not one that any business takes lightly. At ILG we liken it to entrusting your children to a babysitter for the first time.

Follow Us

A peek behind the scenes at our Beauty Vibe panel…

A peek behind the scenes at our Beauty Vibe panel yesterday, The Power of Purpose. We’ll be sharing key insights from our panellists over the coming weeks, so be sure to check back for updates. Also, don’t forget to sign up for our newsletter to hear more about upcoming events and for first access to our industry reports (link in bio). #purpose #givingback #sustainability #beautybusiness #entrepreneur #beautystartup

https://www.instagram.com/reel/C53Opx_haOa/

Yesterday, we had the pleasure of hosting a…

Yesterday, we had the pleasure of hosting a sold-out panel event from The Beauty Vibe series with @vibepartners. With a wonderful panel of industry experts, we discussed the power of meaningful brand purpose and how this translates to customers, to drive long-term business growth, loyalty and trust. Thank you to all the panelists, @sable.labs, @scampanddudejo, @aimeeconnolly_com, @freethebirdsldn, @aisling_connaughton and Tom Ashley for their insightful input into the morning’s discussion.

https://www.instagram.com/reel/C52971By9qD/

Behind the scenes at one of our recent photoshoots…

Behind the scenes at one of our recent photoshoots 📸 We spent the day capturing our state-of-the-art warehouses, our amazing team, and the incredible products of our prestigious customers! #WeAreILG #Fulfilment #warehouse

https://www.instagram.com/p/C50b_HAsPfM/

SOLD OUT! Tomorrow we’re welcoming some of the…

SOLD OUT! Tomorrow we’re welcoming some of the beauty industry’s most influential leaders to a sold-out panel discussion exploring the power of meaningful brand purpose. The core insight about the notion of ‘purpose’ is that it matters – not just in an abstract sense, but in terms of today’s business metrics. Follow the link in our bio to learn more about our Beauty Vibe panel series and apply to attend our next event. #beauty #beautypanel #beautyinsights #purpose #sustainability #bcorp #DEI #diversity #inclusion #givingback #entrepreneur #beautycustomer #beautyfulfilment

https://www.instagram.com/p/C5yHqUHK3qD/

Reflecting on peak 2023 (and just as our planning…

Reflecting on peak 2023 (and just as our planning for peak 2024 starts!) we’re thrilled to have received some amazing and constructive feedback from our valued customers. Read more about how we scored, and find tips to support preparations for your next peak, in our Peak Hub on the link in our bio! #Peak #Fulfilment

https://www.instagram.com/p/C5iHrqAu9EB/

Returns have become an inevitable part of online…

Returns have become an inevitable part of online shopping, and in the beauty industry, they play a significant role in customer satisfaction and brand loyalty. Read more on the link in our bio about the Beauty of Seamless Returns: Why Working with a 3PL is Essential!

https://www.instagram.com/p/C5VdGVasj7R/

Today we wore blue to show our support for World…

Today we wore blue to show our support for World Autism Awareness Day! 🧩💙 Join us as we celebrate the unique talents, perspectives, and contributions of individuals on the autism spectrum. Together, let’s create a more inclusive and understanding society. #AutismAwareness #Inclusion #WeAreILG

https://www.instagram.com/p/C5Q7DDsIQHN/

We are thrilled to announce that ILG has been…

We are thrilled to announce that ILG has been awarded the prestigious RoSPA Gold President’s Award for 2024. This award is made for ‘sustained achievement’ after winning 10 consecutive RoSPA Gold Awards. Read more in the blog on the link in our bio!

https://www.instagram.com/p/C4-su0VocoU/

The Beauty Vibe, Series 2! Last week we visited…

The Beauty Vibe, Series 2! Last week we visited London and Brighton with @vibepartners to film consumer interviews and gather juicy insights for the next Beauty Vibe panel event, coming soon!

https://www.instagram.com/p/C48LPeOMgWF/

🌸✨ Happy International Fragrance Week!…

🌸✨ Happy International Fragrance Week! ✨🌸 This week, we’re celebrating our clients whose businesses thrive on the essence of fragrance! Explore our beauty fulfilment services and discover how we can elevate your fragrance brand on the link in our bio! 🌟 #InternationalFragranceDay #ScentedSuccess #Fulfilment

https://www.instagram.com/p/C4uuDZ_KGBB/