Insights and News

Read the hottest ILG news and fulfilment and delivery insights in our stories, ebooks and videos below. For the most recent customer updates, please visit the My ILG page.

26 March, 2024

ILG Receives RoSPA Gold President’s Award

We are thrilled to announce that ILG has been awarded the prestigious RoSPA Gold President’s Award for 2024.

23 February, 2024

ILG Acquires Global Freight Solutions (GFS)

We are delighted to announce that ILG has acquired Global Freight Solutions (GFS), a pioneer in Enterprise Carrier Management (ECM).

29 January, 2024

ILG Achieves EcoVadis Bronze for Sustainable Practices in Fulfilment and Delivery

We’re pleased to announce ILG has been awarded the EcoVadis Bronze Award. Read more about our sustainability journey here.

12 October, 2023

Zero-By-Thirty for 100% Sustainable Fulfilment

We became acutely aware that our commercial success was having a mounting impact on the environment. We needed to do something about it, and quickly.

07 July, 2023

CEW Beauty Awards 2023!

ILG had the pleasure of sponsoring the 2023 CEW Beauty Awards and on 30th June, the winners were announced in a spectacular ceremony at The Londoner Hotel. We’re thrilled for all of the brands that were nominated as finalists, and picked up awards.

05 July, 2023

ILG Wins UKWA Excellence in Customer Service Award!

We are delighted to announce that ILG were crowned winners of the Excellence in Customer Service Award at the prestigious 2023 UKWA Awards!

22 May, 2023

We Are ILG: The ILG Annual Awards for Excellence

Last Saturday we held our fabulous annual awards evening to celebrate the fantastic achievements made over the last 12 months!

10 May, 2023

ILG is ISO 14001 Accredited!

We are thrilled to announce that ILG has been awarded the ISO 14001 certification, demonstrating our commitment to environmental sustainability and responsible business practices.

12 October, 2022

ILG’s Support for Aldingbourne WorkAid

The Aldingbourne WorkAid scheme supports people with learning disabilities and/or autism by finding them suitable paid employment. ILG is supporting WorkAid by producing marketing materials to attract new prospective employers.

14 September, 2022

Sustainable September at ILG

Sustainable September aims to promote ILG’s understanding of sustainability issues and embed greener practices across all our staff and facilities.

18 July, 2022

ILG Offers Organic Fulfilment!

ILG is pleased to announce that three of our facilities have been organic certified by the Soil Association.

29 June, 2022

ILG Wins Two UKWA 2022 Awards!

ILG is excited to announce that we have won 2 of the United Kingdom Warehousing Association’s 2022 Awards!

24 May, 2022

ILG Awards for Excellence… The Winners Are

The ILG Awards for Excellence were back, in-person, and better than ever earlier this month. We got together to celebrate our wonderful colleagues and the exemplary work that has been achieved.

09 May, 2022

Women in Logistics and the Beauty Supply Chain

At ILG, we celebrate and embrace diversity in the workplace. 41% of our workforce is female, which is almost double the average proportion for warehousing and logistics businesses.

13 April, 2022

Autism Awareness Day with ILG

We recently took the opportunity to embrace and celebrate the unique talents and skills of those with autism, by celebrating World Autism Awareness Day.

23 February, 2022

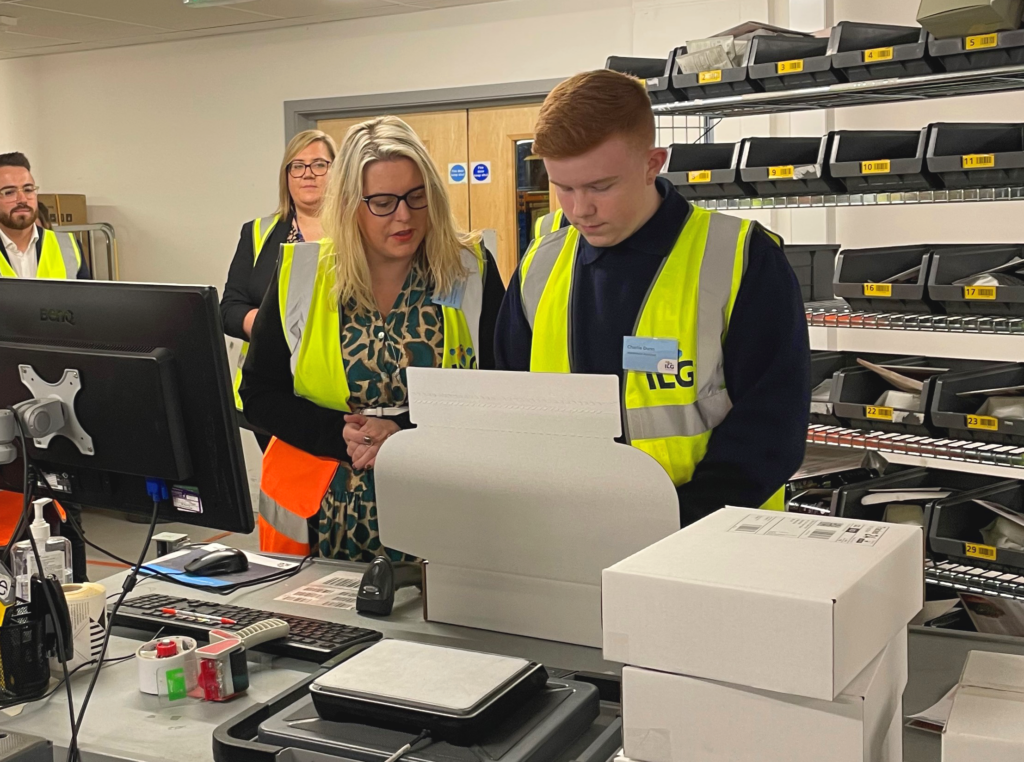

Minister for Employment Meets ILG Kickstarters

Last week, we were delighted to welcome Minister for Employment Mims Davies MP to our East Grinstead warehouse.

13 September, 2021

ILG Takes a Big Step into the Midlands

We’re happy to announce that ILG Brackmills, our brand new warehouse in Northampton, is now open.

25 May, 2021

Brexit and the Road to Poland – Part 3

The Founder of Little Green Radicals talks about the advantages of moving stock to the EU in Part 3 – The client’s tale.

23 April, 2021

Brexit and the Road to Poland – Part 2

Our decision to open a warehouse in Wroclaw, Poland, was signed off in September 2020 and I was assigned to manage the project the following month.

08 April, 2021

Brexit and the Road to Poland – Part 1

In January 2020, with one year left until the UK left the EU, we made the decision to prepare a contingency plan in the event of a hard Brexit.

23 November, 2020

Building More Space for Black Friday

Watch our video to see how ILG has been preparing to meet record Black Friday demand.

10 July, 2020

ILG’s Got Talent

Many congratulations to Lauren Pratt and Inna Goncharov who tied for first place in our recent showcase of ILG talent.

07 July, 2020

ILG Space Gatwick is Opening Soon

Space Gatwick, situated in Gatwick, West Sussex, UK is ILG’s newest and most advanced fulfilment centre.

20 February, 2020

ILG Annual Awards – The Winners are Announced

A huge congratulations to our employees who were recognised at our Annual Awards Dinner for their exemplary work over the last year both for ILG and for our customers.

29 January, 2020

Forward Planning – How to Best Prepare Your Company for Peak Periods

Last year’s peak November sales period was our busiest ever at ILG – by some considerable margin – and feedback from our clients shows that it was a successful period for our customers too.

14 February, 2019

Never Mind the Baftas – Look at the ILG Superstars

At ILG we believe strongly in investing in our people so Saturday night saw the ILG Annual Awards Dinner.

02 August, 2018

ILG and Yusen Logistics: a New Strategic Alliance

ILG is pleased to announce its acquisition by Yusen Logistics, a leading player in international ocean freight, air freight and contract logistics.

22 March, 2018

ILG Named Business of the Decade by Gatwick Diamond

ILG has been awarded the title Business of the Decade at the 10th annual Gatwick Diamond Business Awards (GDBA).